Bear markets are tough. Yes. The market is rigged. Yes. But over the last 120+ years, has investing in the stock market paid off? Yes. Far more than inflation has robbed us of our purchasing power. One of the safest and most reliable methods of investing your money remains unchanged: Finding companies that are trading at nice discounts relative to their future expected values. Of course, putting in the time and effort to research and understand companies like Amazon, Netflix, Facebook, and Google can be extremely difficult. But luckily, there are tons of broadly diversified indices out there that will undertake the research and design healthy portfolios for us. SPY, QQQ, VTI, and VOO are all great examples of this. You can pick your favorite indices after doing some research, and focus entirely on investing in these. Then, combine this with virtually the best options trading strategy to employ during bear markets, and you'll end up with a very successful portfolio long term.

The biggest challenge that the average person runs into is mentally navigating through downturns. After the market drops by twenty-five or thirty percent in just a year, it feels like you lost two full years of investing gains. In times like these, if you’re not doing anything to help navigate or soften these downturns, then you’re just going feel like you've thrown out a solid couple of years of investing away. Despite how painful it may be to pull the trigger, long term investors have always benefitted from buying consistently throughout both bear and bull markets. Bear in mind that the period that comes directly after a major downturn tends to be one of the strongest rallies. The median one-year performance directly after bear markets is just around 23.9%, according to WSJ.

So the ultimate question is: How can we leverage options to help us withstand some of these downturns? Well, bear markets usually result in a prolonged elevated period of market volatility, which leads to a surge in the VIX (volatility index). Consequentially, premium prices are elevated across the board - for both puts and calls. This makes sense, because we'll see days where the market is up 2.7%, then down 3.2%, then up 1.9%, then down 3.5%, etc. The average bear market lasts about 289 days, or just over 9 months, according to Seeking Alpha. Secondly, they take place every 3.5 years, which means the market is in a bear market about 21.4% of the time. So that means for about 9 months at a time every 3.5 years, we're forced to sit through prolonged periods of elevated premiums with a dropping market. How do we combat this? By selling options - both puts and calls.

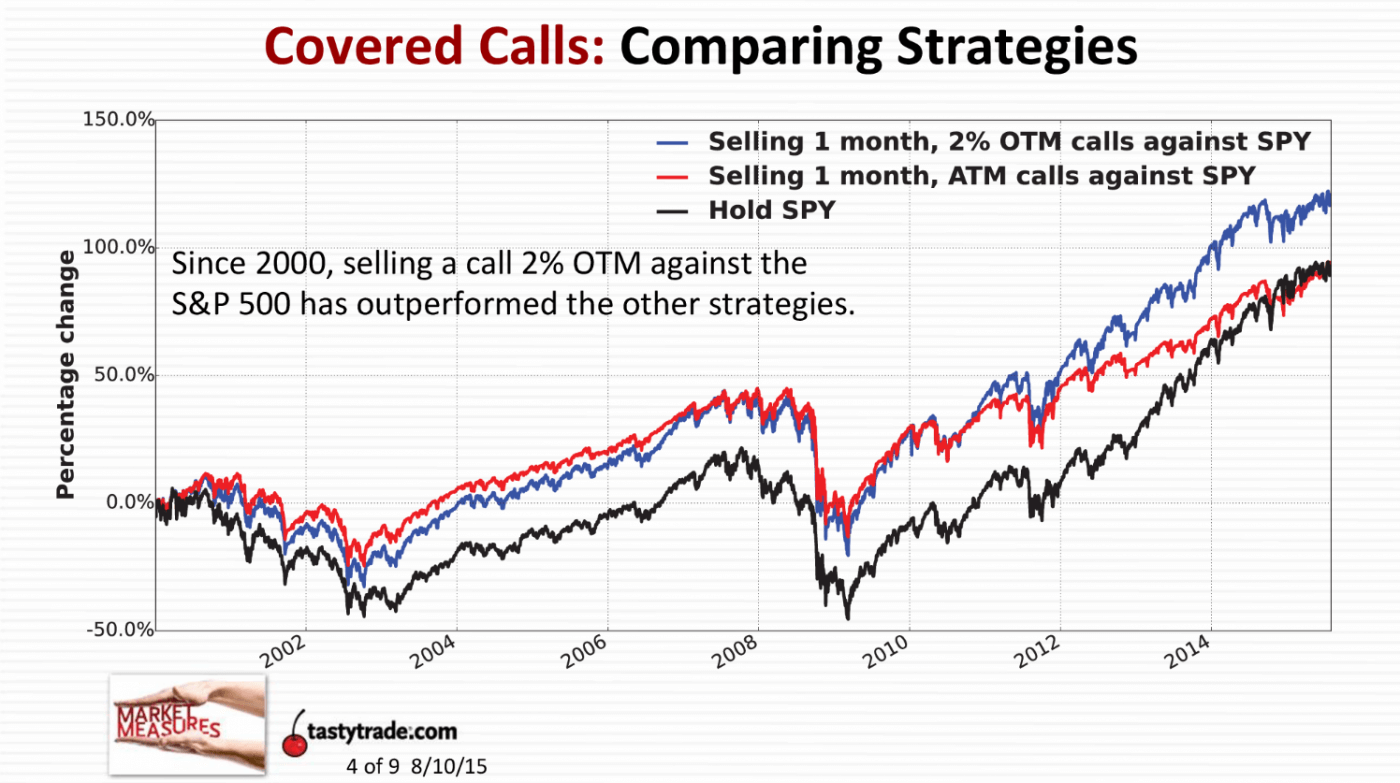

In the world of options, speculative traders are constantly misled to believing that options are lottery tickets. Especially in bear markets, traders will take large speculative bets against the market or a particular stock by heavily buying puts, only to find out later that the market did not drop fast enough to reward them for taking the trade. The vast majority of premium sold either expires worthless or is closed out early, with the statistical edge always falling on the side of the seller. Especially with an elevated VIX, premiums will steadily increase to reflect the changing dynamic of the overall risk present in the market. The most important method to leverage during these times is to sell covered calls against your underlyings. You can take highly technical approaches by selling calls at levels that the market most recently broke down from, or select specific strike prices directly above some heavy resistance points, such as the 200 Day Simple-Moving-Average. If you isolate the covered call strategy out into bear markets alone and quit when the market re-enters a bull market, then you will still quickly differentiate yourself amongst other investors. Below, you can see the returns of blindly selling covered calls for over a decade, through both bull and bear markets.

The strategy that shines the most is selling 1 month out 2% OTM calls against the SPY in the long run. However, during the bear cycles, like the ones in early 2000 and 2008 on this chart, selling the ATM 1 month covered call was a winning strategy. But in any strategy involving covered calls during falling markets, notice that it outperforms just holding onto the index. At certain points, the difference in performance can be upwards of 40% higher by selling covered calls. During tough markets, this can help you deliver the results you were missing.

Let's run an example on the QQQ with today's numbers. Let's say your average cost basis on the QQQ is $200 per share, and you own 100 shares of this index. Today, June 21st, the QQQ is hovering right around $280 per share, down from a high of $408.71. At the peak, you were up over 100% on your investment. Now, you're only up around 40%. Based on today's price, we can sell a one-month out call option expiring on July 22nd, and sell nearly a 9% OTM call option with a $305 strike price for just about $3.00 per contract, or $300 in premium. That means that, as long as the QQQ stays below $305 by next month, you'll get to keep $300 for simply holding onto the index. Keep in mind that this is conservative as indexes rarely ever go up 9% in a single month. So how does this benefit us? Well, we earned about a 1.5% return on our original investment of $200 per share, and added around 1% of downside protection. This means that over a nine-month bear market, we can conservatively reduce our cost basis by over 13.5% by selling these covered calls. This can provide us with roughly $2,700 in cash that we can either use to pick up additional positions, deploy elsewhere, or just keep in case of emergencies. All for virtually no extra work, and very little risk.

Some will bash selling covered calls due to the "assignment risk." Yes, covered calls do have an assignment risk, but if you learn the basics of technical analysis, risk mitigation, and understand when to be the most aggressive, and when to pull back, you can overcome this and still come out largely ahead. One simple strategy to deal with challenged call options to prevent assignment risk is to simply roll your position to a later date and higher strike as much as possible, and you can even get more creative to include some short puts in there to help manage a challenged position. But the key is to employ this strategy primarily when the market is appearing to go down or sideways, and less when it's making a monstrous bull run under a low VIX.

Additionally, another strong lever you can pull if you have a certain level of capital is to sell puts during bear markets. For example, with the QQQ at today's price, we can sell some July 22nd $255P for over $3.15, or $315 per contract. When the VIX is high and there's a great deal of fear, selling puts can be a very lucrative strategy to deal with undeployed cash sitting in your brokerage account. If the put expires worthless, then you keep the entire $315 and can use it to buy more shares, further reduce your cost basis, or keep as emergency funds for something else. Or, if the market manages to drop over 9% in a single month, then you can take action to manage your position by rolling the strike price down some, or eventually just accept assignment because you're ultimately expanding your portfolio for the better. This can additionally provide you with another 1-1.5% return per month, or $2,815 over the 9-month bear market.

Now, if we combine both of the strategies above, what do we get? At the very least, we can protect our portfolio's downside by around 2% per month conservatively. Let's say the market remains in a 9-month bear market where it drops 30% from its high. Well, you may only be down 10-12% by deploying these two strategies, and you'd come out of it with roughly $5,500 in extra cash in your brokerage account. Remember, your cost basis is $200 per share on the QQQ, or $20,000, so you literally just reduced your cost basis by 27.50% per share, bringing it down to $145 per share. You can also redeploy this back into the QQQ by increasing your position in the QQQ further by about 20%, since you can deploy the cash to buy more shares at a cheaper value. If do do this more and more incrementally as the QQQ rises in price over the years and enters subsequent bear markets, you can effectively pay yourself for the entire position and consider your investment completely risk-free, like a property that has been paid off using a renter's contribution.

Of course, these are highly simplified explanations with most of the technical details being brushed over. However, we cover all of the nitty gritty details in our options trading course, which is launching soon! The point that we'd like to drive home is: Don't be scared of bear markets. Look at them with excitement since they're times of incredible opportunity, since the masses are and will continue to be soaked in fear.