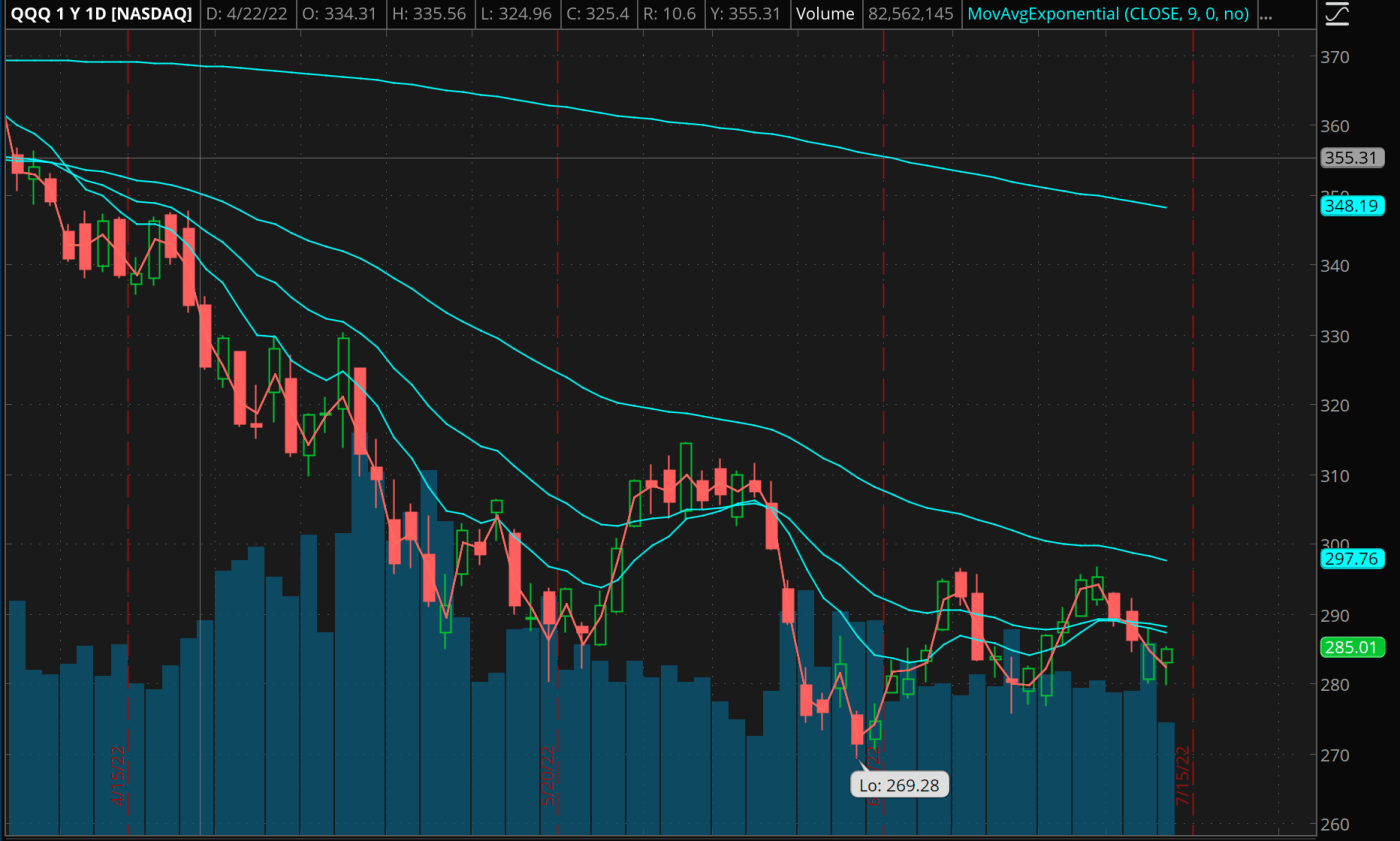

We're just about halfway through July and the stock market has appeared to have gone essentially nowhere. The good? Well, at least it hasn't gone down further and is sitting close to mid-May levels. But the bad - the market has just been consolidating without going up net over the past couple of months. So, where do things look like they're going from here? Here's our quick stock market recap for Thursday July 14th, 2022.

Based off the technicals, there's definitely some positive signs that are starting to manifest. Namely, despite being below all of the market's major moving averages, the market has failed to form a new low on nearly two separate occasions now. As you can see - the low of $269.28 was put in on June 16th (nearly a month ago) and since then the market has come

Meanwhile, the VIX is still sitting at $30.19, which is still relatively high volatility. Given this technical environment, we're planning to continue selling premium - selling some puts when the market goes down and calls when it tries to make a relief move. During high VIX periods, forget about making any money on call options that are purchased with the intent to hold for a few days or more. Even the strong names in the energy sector have been seeing failing breakouts consistently for the past five to six months. Buying puts can occasionally be lucrative, but a surge in the VIX makes the probability of seeing large returns very difficult. The market is already pricing in a great deal of volatility, and we all know that the market notoriously overprices volatility during tough times.

Yes, it's been much more tough to make money with strategies that thrived all through last year with breakout after breakout. But this price action is a friendly reminder that nobody, not even the best traders, are invincible. The goal in these time periods is never to aim for home runs, you want to focus almost entirely on base hits that keep your account hanging in there while playing damage control to the downside. What we can say with 100% certainty is that the good times will be back, likely sooner than anyone thinks, and we'll all be off to the races again with some incredible gains once again. For now, this is just not the time to be aggressive.