Taking advantage of call options on stocks hitting all-time highs during a fresh bull market requires a technical approach that incorporates precise entry points, effective risk management, and strategic exit strategies. In this blog post, we will delve into the technical details of playing call options in such scenarios, providing insights on when to enter trades, implementing risk management techniques, and determining optimal exit points.

1. Identifying Entry Points:

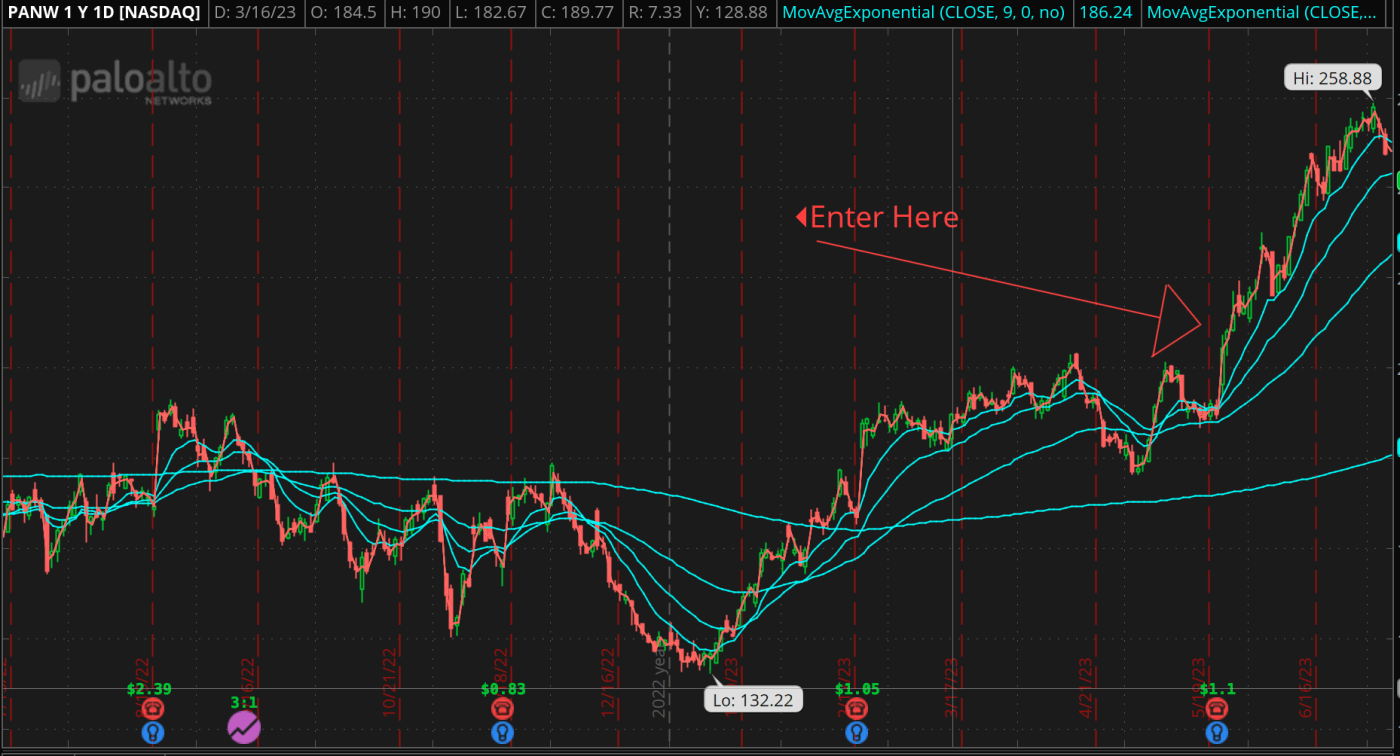

To pinpoint the ideal entry points for call options, technical analysis plays a vital role. Look for stocks that have recently broken out to all-time highs with strong volume confirmation, indicating strong buying pressure. Additionally, assess the stock's price action and trend indicators, such as moving averages and trendlines, to identify potential entry points on pullbacks or consolidations. Consider waiting for a minor retracement or consolidation pattern to provide a favorable risk-reward ratio before entering the trade.

2. Implementing Risk Management:

Proper risk management is crucial when trading call options on stocks at all-time highs. Set a predetermined risk level for each trade, typically a percentage of your overall portfolio or capital allocated to options trading. Consider placing a stop-loss order just below a significant support level or a technical indicator, such as a moving average or trendline. This helps limit potential losses if the trade does not perform as anticipated. It's important to adhere to the risk management plan and not let emotions drive decision-making.

3. Monitoring Price Action and Technical Indicators:

Once in a call options trade, closely monitor the stock's price action and key technical indicators. Use momentum indicators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, to gauge overbought conditions and potential reversal points. If the stock becomes overextended and shows signs of slowing momentum or bearish divergence, it may be an appropriate time to consider taking profits or adjusting the stop-loss level to protect gains.

4. Scaling Out and Adjusting Positions:

Consider scaling out of the call options position as the stock continues to rise. This involves selling a portion of the contracts to lock in profits while still maintaining exposure to potential further upside. As the stock price reaches key resistance levels or exhibits signs of exhaustion, consider adjusting the stop-loss level higher to secure additional profits and protect against potential downside risk. This approach allows for the capture of partial gains while still participating in the stock's upward movement.

5. Determining Exit Points:

Exit strategies in call options trading should be based on the fulfillment of predetermined profit targets or the occurrence of specific technical signals. Consider taking profits when the stock price reaches a predetermined resistance level or shows signs of extended overbought conditions. Additionally, if the call options reach a specific profit target, based on either a percentage gain or a pre-established price level, it may be prudent to exit the position entirely. Regularly reassess the stock's technical indicators and adjust exit points accordingly to optimize profits and minimize losses.

Conclusion:

Trading call options on stocks hitting all-time highs in a fresh bull market requires a technical approach that focuses on precise entry points, effective risk management, and strategic exit strategies. By combining technical analysis tools, setting clear risk management parameters, and monitoring key technical indicators, traders can enhance their chances of success. Remember to maintain discipline, stick to the trading plan, and continuously adapt to changing market conditions. Implementing these technical details will help maximize potential gains while mitigating risks in call options trading during a new bull market.