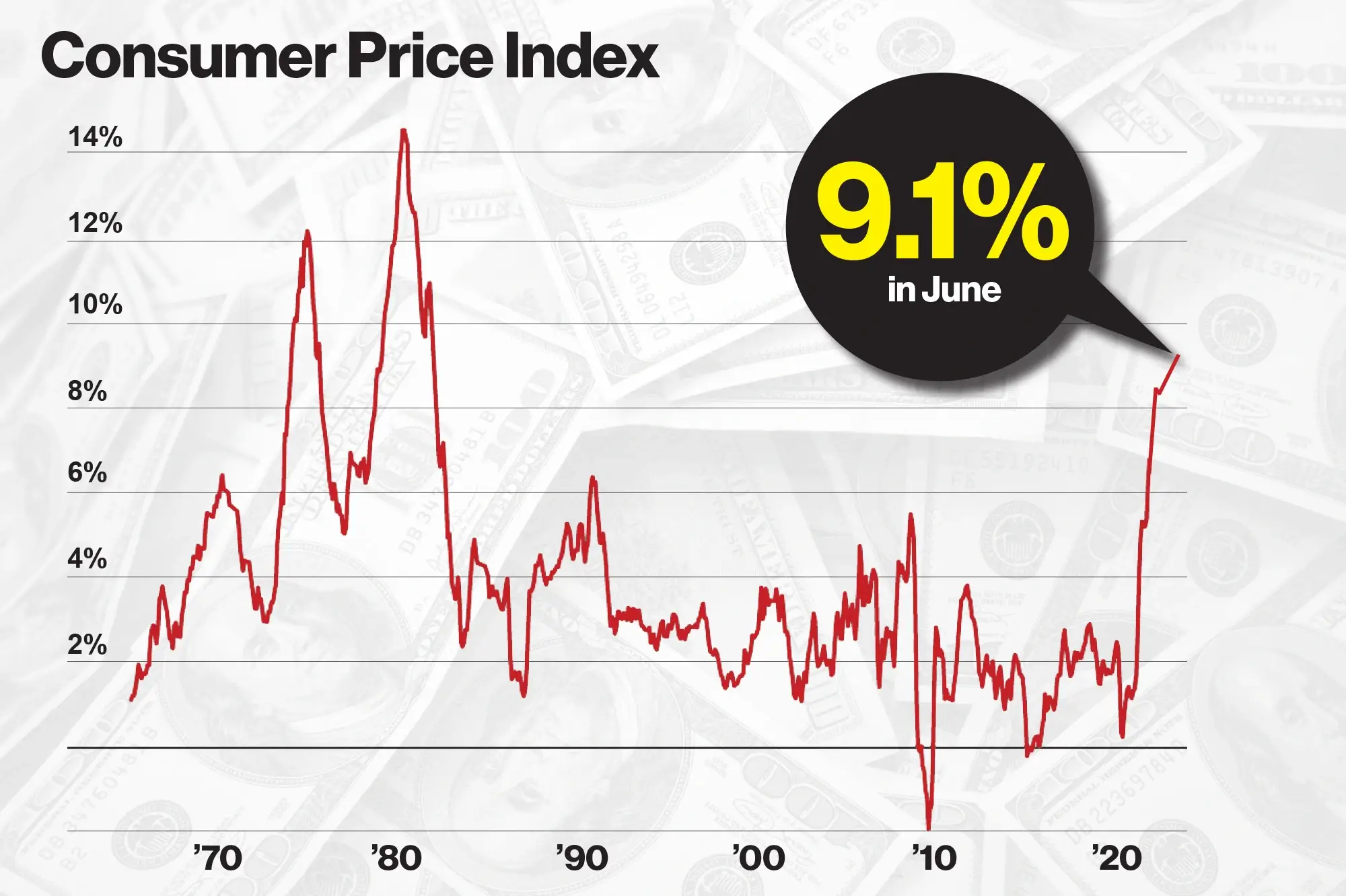

We received news earlier this week that inflation has actually not begun to inflect back down just yet. The overall inflation headline came in at a whopping 9.1% annualized rate, up from an already whopping 8.6% the month prior. When the headlines came out, the broader markets instantly gapped down sharply and sold off into the session open. However, it did reverse and make up for the losses fast midway into the session. Well, is this all bad news? Let's discuss how inflation affects the stock market.

Well, there is still some good news to parse out of the report. The primary piece of good news here is that the core inflation - when you exclude food and energy costs - actually did inflect down to 5.9%, from 6% the month prior. So there is some light at the end of the tunnel, as we're starting to see some of core numbers actually stabilizing. This makes sense, because if you think about the comps that these numbers are being put against from last year, it only makes sense that the numbers begin coming down. If they didn't, that would be a sign that we're likely headed into a period of hyperinflation. But for now, this does not appear to be the case. However, it's clear that we're now at a 40-year high in inflation; and the last time inflation was this high, the market infamously got "rug pulled" due to Paul Volcker driving rates up north of 20% to control it.

However, what is clear is that this inflation is not transitory. Even though the FED and multiple news outlets tried to convince us for many months on end that it's just "temporary," this obviously has yet to be the case. We are likely going to continue heading down a path of elevated inflation for months - perhaps even years to come. Additionally, the FED funds rate will likely take another big leap forward - of either 50 basis points or perhaps even another 75 basis point hike - to fight the inflation. This means that the cost to borrow money will increase further, in an effort to cool off the economy and slow demand. On the bright side, at least the FED is learning an important economical lesson: When you print thousands of dollars of checks and put them in the hands of people, that will stimulate demand and drive up prices.

In terms of how inflation affects the stock market - there could definitely still be some tough times to come. When borrowing money becomes more expensive, it's only natural for investment philosophies to tilt towards a more conservative style in order to escape the "riskier" companies. Software & Tech companies are commonly categorized under these "riskier" plays during periods of high rates, so they will likely not be a safe haven anytime soon. Additionally, the masses are still not totally phased by the drop that has taken place thus far. In order for a true bottom to be put in place, we need to see clear signs that the average "investor" that partakes investing as a side hustle for one hour a month from their bed has exited the market. Once we see true capitulation and real fear on the streets, that's typically one of the clearest signs of a bottom that we can get.

In terms of options trades, the VIX continues to drop - and fell to 24.22 today. This indicates that fear in the short term is starting to subside and investor confidence is beginning to return. The market has been resistant in many of the last few sessions when it would drop early on but then somehow find a means to rebound to neutral or even positive. We still don't know whether this is just short term noise, because bear markets do have tons of these elongated consolidation periods followed by massive declines. But of course, the most important thing is to not be married to any one scenario and realize that anything can happen at any point - the market is dictated by people's votes via their capital after all. There are still no signs yet that the market's price action has turned bullish; breakouts are still failing across the board. However if the market does manage to break out of this consolidation in either direction, that could be a good opportunity to buy some puts or calls depending on which way it goes. Sure, the trend may not last for several weeks or months, but it may prove to be a good opportunity for short term option swinging.